[ad_1]

Bitcoin’s price grew by around 10% during the last seven days, marking its strongest weekly performance since June. Market observers have attributed this positive price movement to speculation surrounding a potential spot Bitcoin exchange-traded fund (ETF).

Over the past week, the top cryptocurrency’s price touched the $30,000 mark on several occasions as the market positively reacted to the ETF approval rumors. BTC was trading for $29,688 as of press time, according to BeInCrypto data.

BTC Strongest Weekly Return in 17 Weeks

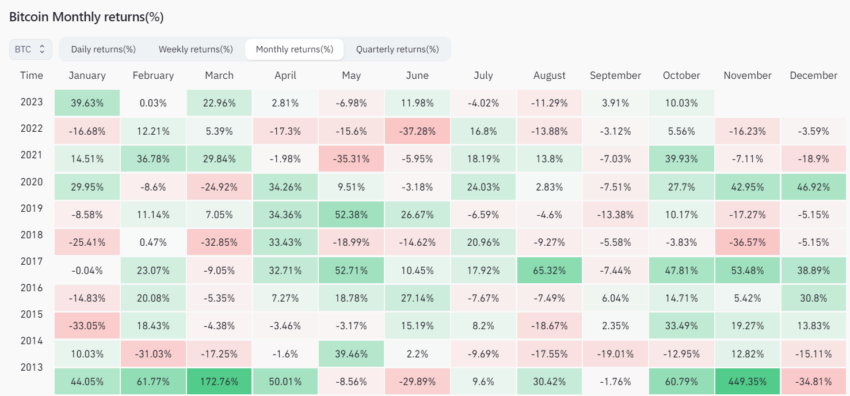

Data from Coinglass indicates that the recent upturn in the top digital asset performance marks the most significant gain since the 25th week of the year, back in June.

During that period, BTC’s value surged by over 15%, only to be followed by 16 weeks of relatively muted performance.

Notably, this particular week aligns with the period when various asset management firms, including BlackRock, commenced their application for spot Bitcoin ETFs with the U.S. Securities and Exchange Commission (SEC).

Meanwhile, BTC’s monthly return for October is also on the cusp of matching that of June, per Coinglass data. Bitcoin managed a modest 3.91% gain in September, marking a significant improvement over August’s downturn of -11.29%.

However, available data shows that this month’s returns have already reached an impressive 10.03%, closely trailing June’s 11.98%.

ETF Speculations

BTC’s recent positive price performance is closely linked to the growing speculations surrounding the SEC’s decision on an ETF.

Earlier in the week, BTC’s price had surged to more than $30,000 on false reports that the SEC had approved BlackRock’s iShares spot Bitcoin ETF.

While the news was subsequently debunked, observers stated that the market reaction was evidence of the demand for a spot BTC ETF.

This price movement corroborates a K33 Research report that suggested that BTC’s value could surge to above $42,000 during the first 100 days of a spot BTC ETF approval. Other analytics firms like CryptoQuant have a more bullish prediction of above $50,000.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link

Be the first to comment