[ad_1]

Investment firm giant BlackRock has released a new advertisement for its iShares Bitcoin ETF product. The ad is clearly aimed at older, more traditional investors who want to invest in Bitcoin without the risk of keeping custody of the asset themselves.

BlackRock’s iShares took an early lead among the newly approved Bitcoin ETFs in terms of inflows. Will its new ads help to draw in new investors to extend its lead further?

BlackRock Bitcoin ETF Ad Beckons: ‘Get Your Share of Progress’

Bloomberg analyst Eric Balchunas was quick to share his thoughts on the newest BlackRock’s iShares ad. He highlighted the ad’s verbiage, which boldly equates the Bitcoin investment product as ‘progress.’

Balchunas asserted that the ad is mostly directed at traditional investors who likely never considered cryptocurrencies like Bitcoin to be part of their portfolio. He said,

They mention how the ETF standardizes BTC so it is just like the stock and bonds in your portfolio. This is clearly aimed at normal 60/40-ers vs the BTC faithful (who largely don’t own stocks and bonds).

60/40-ers refers to a popular and conservative investment strategy of a mix of 60% stocks and 40% bonds. Many younger investors who dabble in cryptocurrencies prefer to keep custody of their BTC themselves and, therefore, are indifferent to the ETF offerings.

Read more: What Is A Bitcoin ETF?

Balchunas also noted how BlackRock was dominating its Bitcoin ETF peers in liquidity, and this latest ad campaign could cement its pack leader position.

“Strong advisor-friendly vibes. BlackRock on brink of pulling away as the category liquidity king, going for kill with more ads makes sense.”

Competition Heating Up

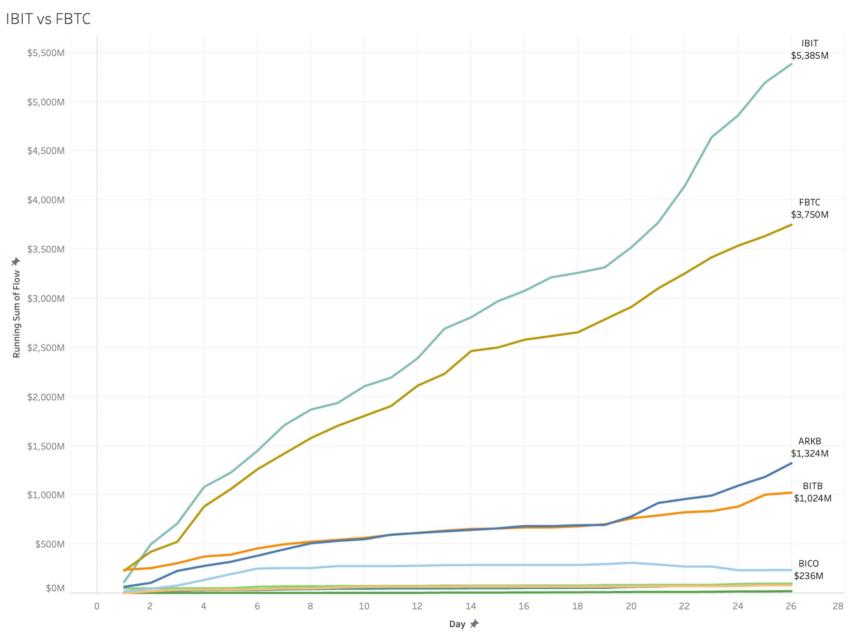

The impact of BlackRock’s strategy is evident in the numbers. Its IBIT ETF has witnessed staggering growth, significantly outperforming its closest competitor, Fidelity’s FBTC.

The gap between the two is widening, with IBIT approaching a remarkable $5.4 billion in inflows, compared to FBTC’s $3.75 billion, according to Bitguide data. The two were essentially neck-and-neck up until about two weeks ago when IBIT started to pull ahead.

CoinShares also noted this surge in crypto flows in its most recent weekly digital asset report. Last week, crypto inflows nearly reached $2.5 billion.

The firm stated that this is the highest level of inflows seen since December 2021, when Bitcoin was cooling off from an all-time high above $69,000 the previous month.

Last week, the Bitcoin price breached the $52,000 level once again before pulling back slightly. Some crypto analysts say that the Bitcoin ETF flows will continue to drive up the price, while others project a cooling-off period ahead of the next halving.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

[ad_2]

Source link

Be the first to comment