[ad_1]

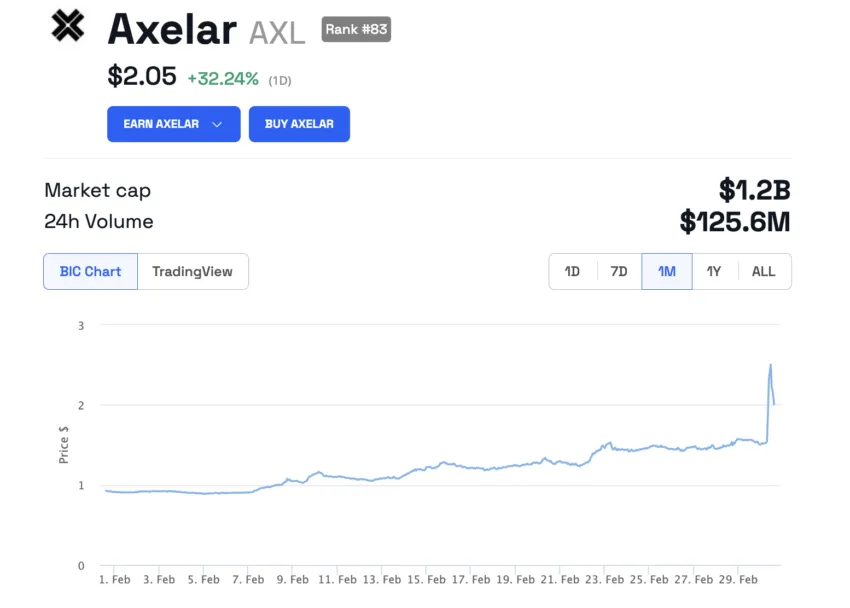

AXL, the Axelar Network’s native token, has recently taken center stage. This Web3 interoperability platform’s token saw its value surge by over 30% after Binance, a leading global crypto exchange, announced it would list AXL.

This event has sparked significant interest among traders and investors worldwide.

Trader Made Over $56,000 After AXL Listing on Binance

Binance’s decision to list AXL, introducing trading pairs such as AXL/BTC, AXL/USDT, AXL/FDUSD, and AXL/TRY, marks a pivotal moment for the token. Trading commenced on March 1 at 11:00 UTC, with withdrawals opening the following day. Furthermore, Binance tagged AXL as a “seed” token, acknowledging its inherent volatility.

The implications of Binance’s listing have been profound for the broader cryptocurrency market. Historically, tokens listed on Binance have witnessed considerable price volatility, and AXL’s case is no exception. The token’s price trajectory has been upward, with derivatives data suggesting a bullish outlook among traders.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

This enthusiasm was further fueled by a trader’s swift gain of $56,000 from trading AXL post-announcement, highlighting the lucrative opportunities presented by such market movements. The trader’s ability to capitalize on the token’s price rally underscores the high-stakes nature of crypto trading, where timing and market sentiment play crucial roles.

“This trader quickly spent 500,000 USDT to buy AXL 1 minute after Binance announced the listing of AXL. Then he sold AXL immediately and got 556,000 USDT. He made 56,000 USDT in only 8 minutes,” Lookonchain elaborated.

The listing of AXL comes at a time when Binance is actively expanding its trading options, with the recent inclusion of other tokens such as Dymension (DYM), Pyth Network (PYTH), and the launch of the USDC-margined ORDI Perpetual Contract. These developments reflect the exchange’s strategy to leverage the ongoing bull market to increase trading revenue.

Read more: 7 Best Binance Alternatives in 2024

Interestingly, this listing follows Binance’s recent removal of several tokens, including Monero (XMR), due to changing standards and compliance requirements. Along with Monero, Binance delisted Aragon (ANT), Multichain (MULTI), and Vai (VAI).

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link

Be the first to comment