[ad_1]

Fintech is witnessing an intriguing evolution as crypto Web3 marketers increasingly shift their focus to the Middle East and North Africa (MENA) regions.

This strategic move is not arbitrary. It is underpinned by three pivotal factors: the surge in digital payments, the growing crypto infrastructure, and the emerging role of Central Bank Digital Currencies (CBDCs). For Web3 marketers, this shift signifies vast opportunities in a landscape ripe for innovative solutions.

The Emergence of Digital Payment Behaviors

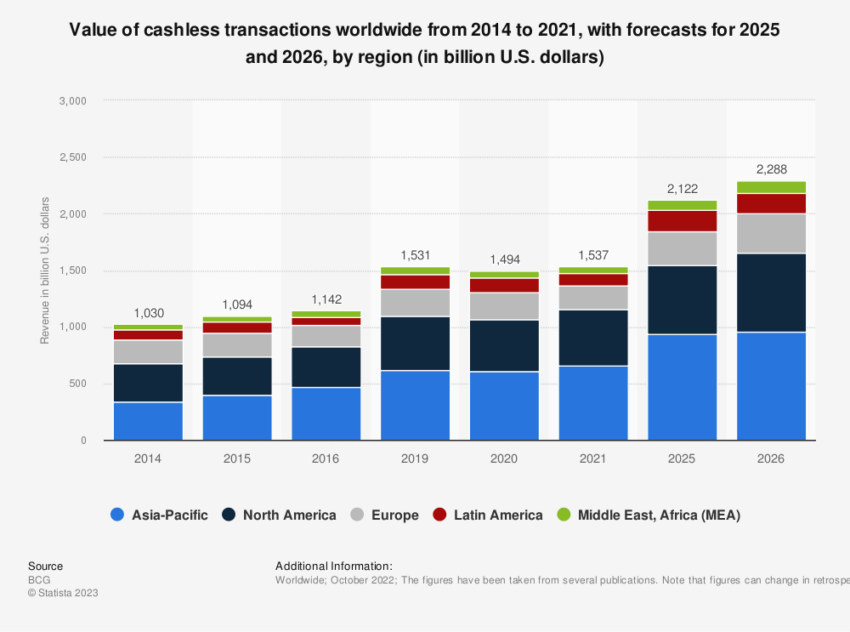

Consumers’ shift towards online financial transactions has been unignorable in the digital era. The COVID-19 pandemic has dramatically amplified the evolution. It triggered a global acceleration towards online shopping and digital transactions.

Both old and new businesses are adapting swiftly to meet this growing demand. Subsequently turning the tide of traditional commerce to favor the virtual sphere.

In the MENA region, this shift in consumer behavior is particularly noticeable. The rapid decline of cash usage, from 26% in 2019 to 16% in 2022, signifies the momentum of digital payment adoption.

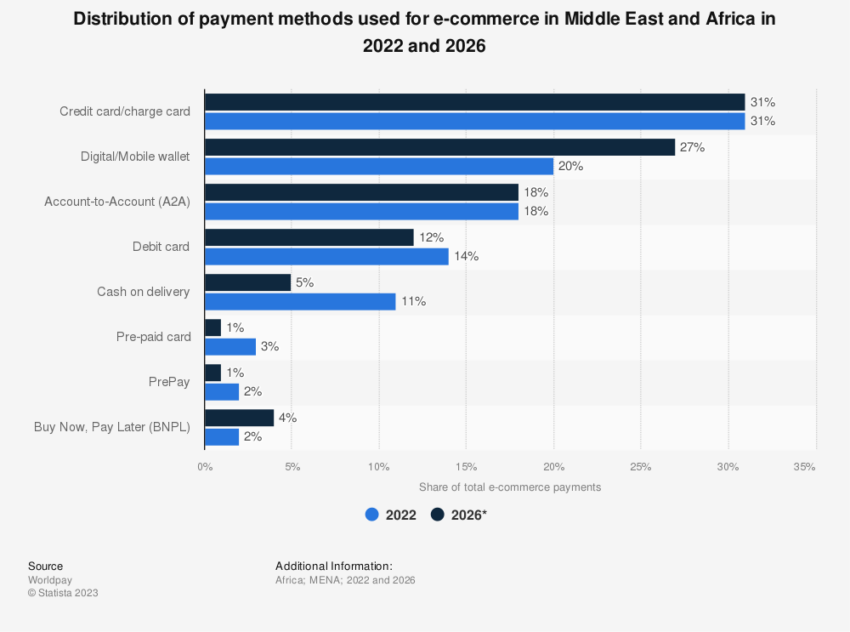

Furthermore, the rise of “super-apps” indicates a strong consumer inclination towards comprehensive, all-encompassing digital platforms. These are following successful Asian models like WeChat and Alipay.

For Web3 marketers, these evolving behaviors offer a broad canvas for innovative customer engagement and retention strategies. The adoption of new payment methods, coupled with the rise of e-commerce, presents opportunities for personalized marketing campaigns, product development, and service offerings tailored to these new digital habits.

Cryptocurrency’s Potential Impact

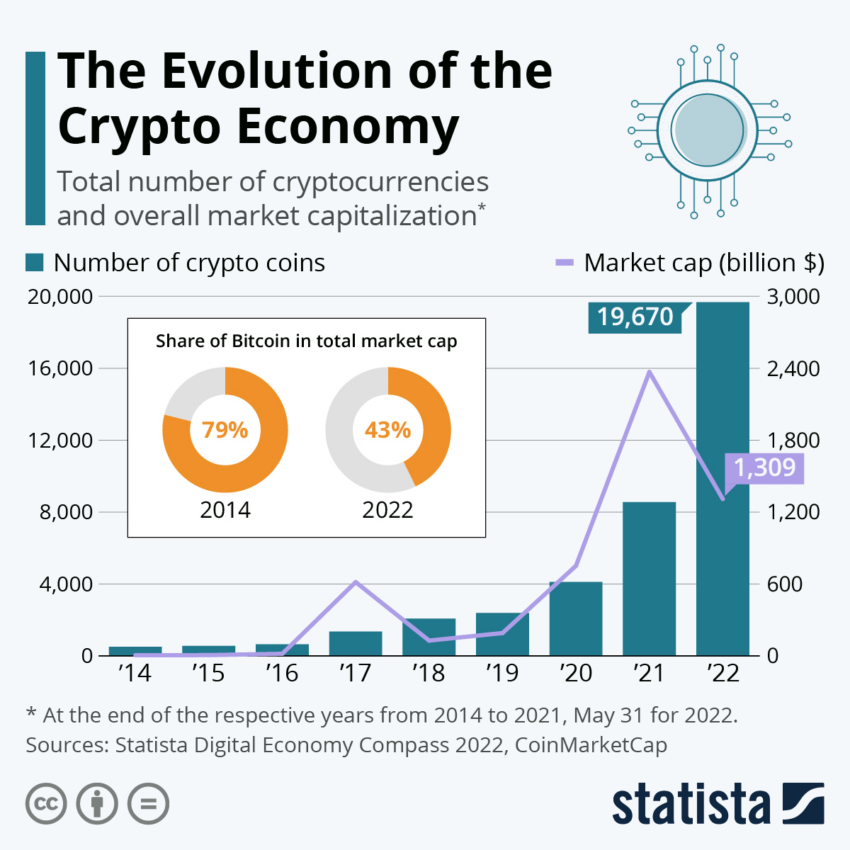

As cryptocurrencies become a mainstream financial conversation, their role is morphing from just an investment asset to a viable payment solution.

MENA-based users received $566 billion in crypto between July 2021 and June 2022, an astounding 48% increase from the preceding year.

This blooming crypto infrastructure presents a treasure trove of benefits for Web3 marketers. Integrating cryptos into payment systems is a game-changer. It enables seamless and faster transactions and ensures enhanced security, reducing the risk of fraud and enabling users to transact confidently.

These features are particularly crucial for populations in regions with less developed banking infrastructure. Therefore, opening doors to financial services that were previously inaccessible.

Furthermore, the surge of decentralized finance (DeFi) applications offers novel opportunities. It allows marketers to tap into a rapidly expanding market of users looking for innovative financial services such as peer-to-peer lending and digital asset trading.

These platforms have the potential to deliver improved financial inclusivity, a key factor for regions like MENA, where a significant portion of the population remains unbanked.

The CBDC Factor

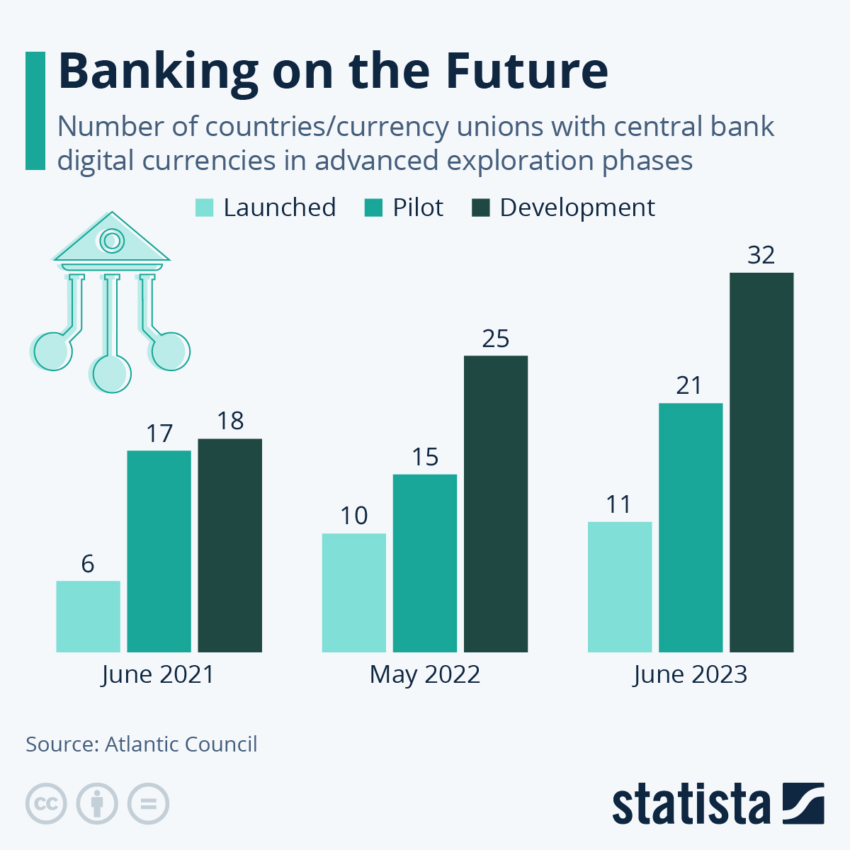

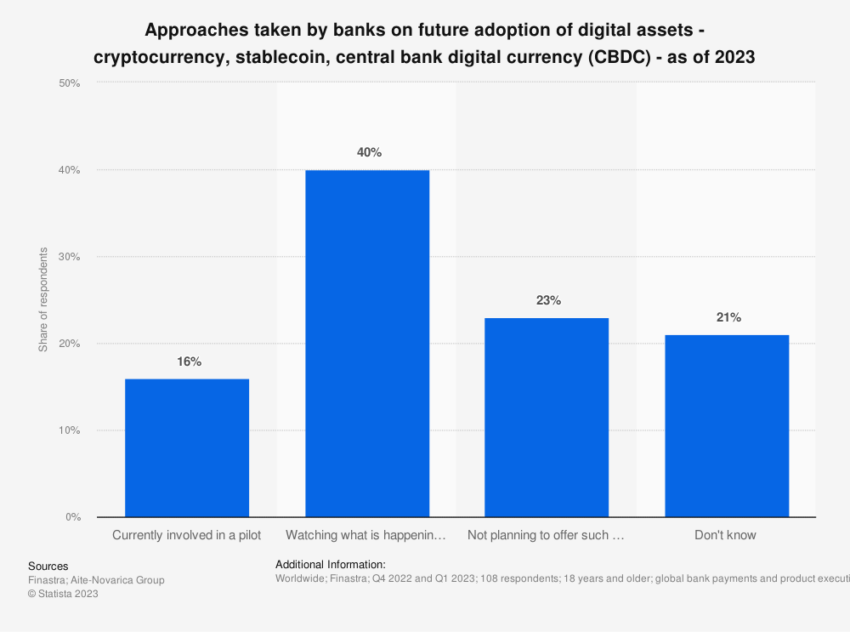

The exploration of Central Bank Digital Currencies (CBDCs) by 86% of global central banks marks a potential revolution in digital finance. This groundbreaking development signifies the transition of physical cash into a digital format.

It bridges the gap between traditional finance and digital assets issued and regulated by central banks.

In the MENA region, nations such as the UAE, Saudi Arabia, and Iran are making significant strides in piloting CBDCs. This underscores a major shift in the acceptance and normalization of digital currencies, which can potentially alter the future of financial transactions in the region.

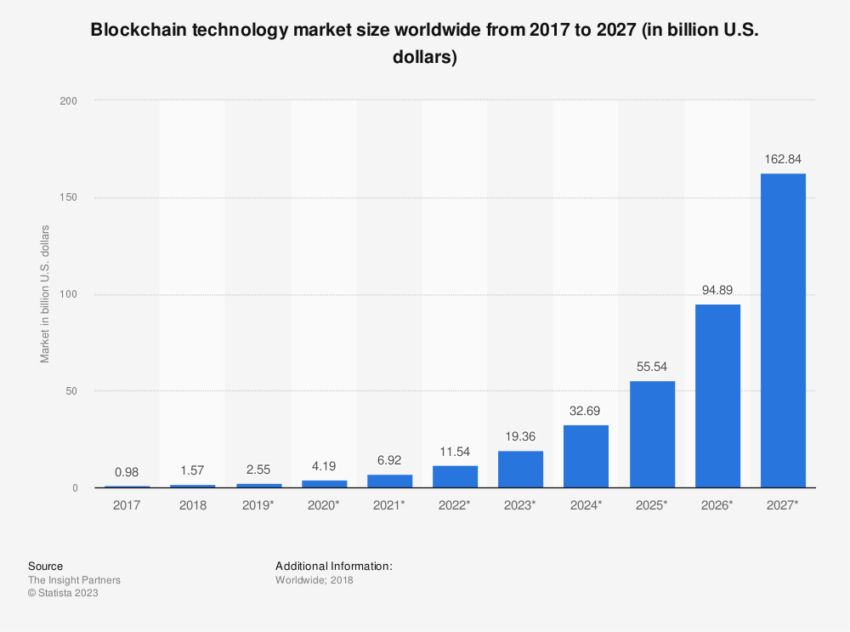

Web3 marketers can leverage this shift to their advantage. The mainstreaming CBDCs would create a conducive environment for introducing new products and services built on blockchain technology.

It would also give marketers a wider audience base familiar with digital assets, making it easier to target and convert.

Moreover, the launch of CBDCs also represents an opportunity to boost financial inclusion by reaching the unbanked population of the MENA region.

CBDCs are designed to mirror physical cash, so anyone with a digital wallet can use them. Therefore, providing access to financial services to individuals outside the banking system.

Regulatory Clarity – A Game Changer

The rapid pace of innovation in the crypto market has exposed the struggle of regulatory bodies to catch up. Yet, even in this uncertain landscape, many MENA countries are taking proactive measures to set rules for crypto transactions.

Clearer regulatory frameworks would be a boon for Web3 marketers. A clear playing field allows for robust Web3 marketing strategies and products confidently designed within a set regulatory framework. Additionally, it helps establish trust, a vital component for adopting new technologies, particularly in the finance sector.

The strategic pivot of crypto Web3 marketers towards the MENA region is motivated by a blend of progressive consumer behaviors, evolving crypto infrastructure, the advent of CBDCs, and potential regulatory clarity.

Web3 marketers find themselves in a region growing with opportunities capable of driving the next big wave of growth in the global fintech space.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link

Be the first to comment